November 9, according to foreign media reports.Canada is strengthening its regulatory regime for the manufacture and sale of e-cigarette products.

From October 1, manufacturers and importers must obtain the permission or registration of the Canada Revenue Agency, affix the stamp of e-cigarette consumption tax on their products, and pay the consumption tax. The transition period is from October 1 to December 31. After that, retail stores will only be able to sell stamped vaping products. These changes come from the revision of the 2001 Consumption Tax Act and its 2022 federal budget regulations.

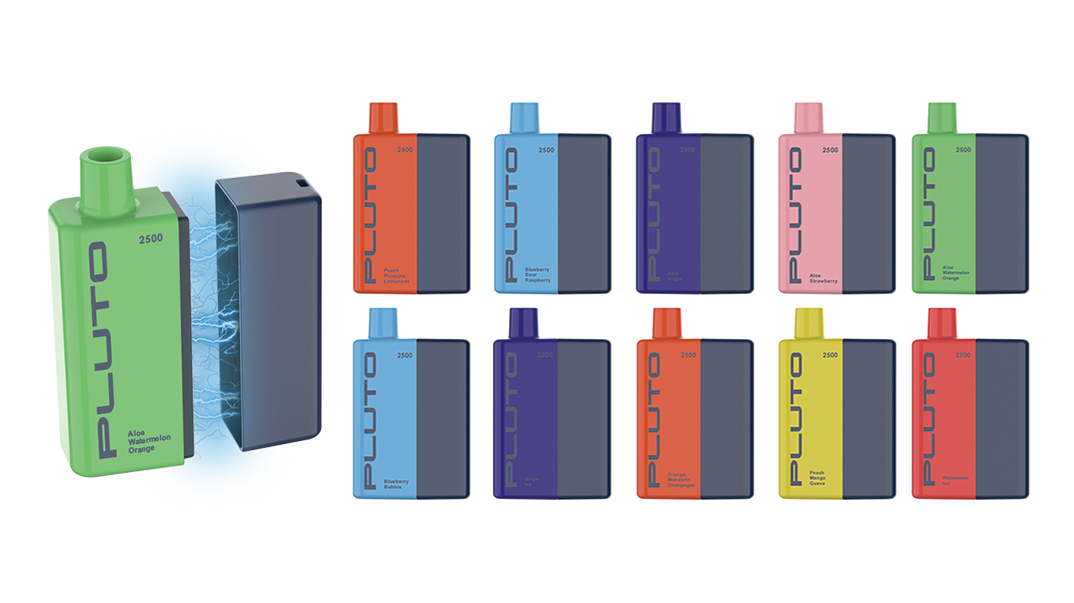

Robert Kreklewetz, indirect tax, customs and trade lawyer of Millar Kreklewetz LLP, said that for tax purposes, these changes mean that the federal government can effectively treat e- cigarette products, such as vape cartridge,vape battery,disposable vape and son on.

A pack of 20 packs of cigarettes is subject to a federal excise tax of $2.91, while roughly equivalent quantities of two milliliters of electronic cigarette liquid are subject to a tariff of $1. He added that this applies to liquids that do not contain nicotine.

Canada also regulates vaping products through the Tobacco and vaping Products Act and the Food and Drug Act, and has regulations to limit nicotine concentrations, as well as packaging and labeling rules.

Kreklewetz said that the tax policy is usually consistent with the public policy, and the consumption tax – sin tax – is attached to the e-cigarette. When the e- cigarette is a less harmful alternative to smoking, it will reduce the motivation of smokers to switch.

Kreklewetz said: If you regard e-cigarettes as a way for current smokers to quit smoking and switch to nicotine consumption instead… Every dollar you tax on e-cigarettes is just an economic obstacle to quitting smoking. If I smoke electronic cigarettes at the same cost as smoking, why should I make changes?

“That’s the fuzzy logic I see in the new tax system.” ’he said. “The way the federal government works these days, it is running out of new sources of revenue. So people might see the vaping tax as a tax grab rather than good public policy.”

Post time: Nov-10-2022